IPO Investing: A step-by-step Framework to find good IPOs!

In this blog, we will explore the intriguing world of IPO investing.

IPOs, or Initial Public Offerings, have become a popular investment option for many individuals looking to enter the stock market. But before you jump in, it’s crucial to have a solid risk mitigation framework in place to analyze and assess IPOs effectively.

Here’s what we’ll cover:

- Understanding IPOs

- How can you scout out new IPOs?

- Step-by-step approach to understand and evaluate IPOs

- What Important points to keep in mind

Understanding IPOs

Let’s begin by exploring the story of IPOs.

IPOs offer an opportunity for companies to transition from private ownership to public ownership by selling shares to the general public for the first time.

This transition enables companies to raise capital for growth and expansion. IPOs can be highly rewarding, as they often provide substantial returns to early investors.

However, it’s important to note that IPO investing comes with its fair share of risks.

How can you Scout out new IPOs?

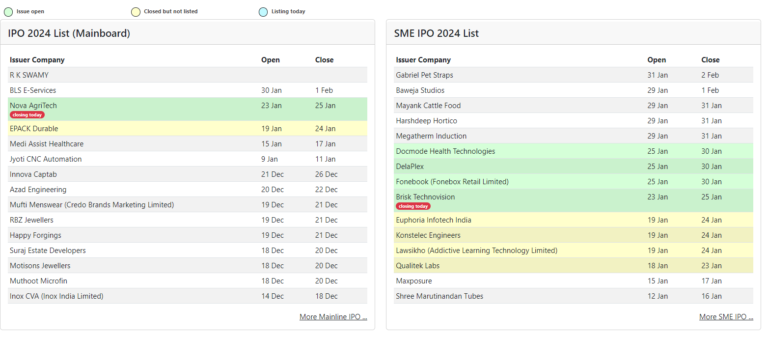

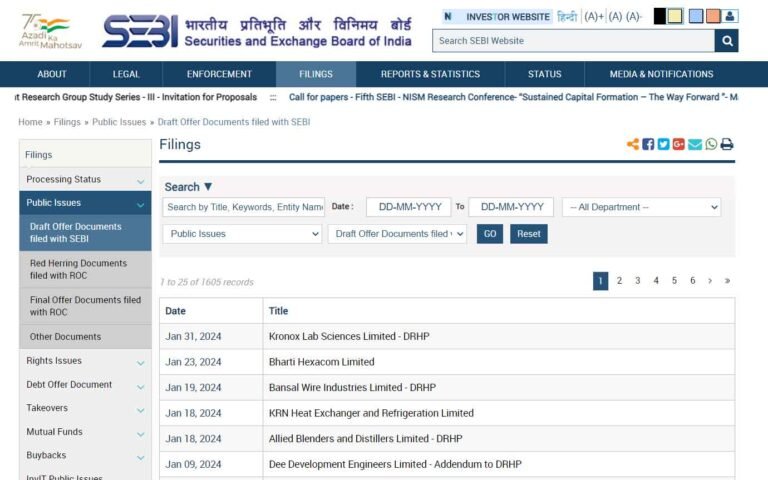

A website to check out upcoming IPOs in India is

As a company closes up on its IPO, it files a Draft Red Herring Prospectus (DRHP).

It’s a document filed by a company with financial regulators before going public, providing information to potential investors about the upcoming initial public offering (IPO).

Now this is an extensive document that holds more than 400 pages of data.

Since most investors won’t have the time to go through the entire document, let’s go through a step-by-step process to analyze an IPO.

The IPO Analysis Framework

Now, let’s dive into the IPO analysis framework that will help you assess and evaluate IPOs effectively:

1. Market Situation and Hype

First and foremost, consider the market situation in which the IPO is getting launched and assess the level of hype surrounding it.

A good market situation is generally favorable for IPOs, but excessive hype can be a red flag. Look for IPOs launched in a good market with moderate levels of hype.

Even an euphoric type of market dynamic can be favorable for IPO investments.

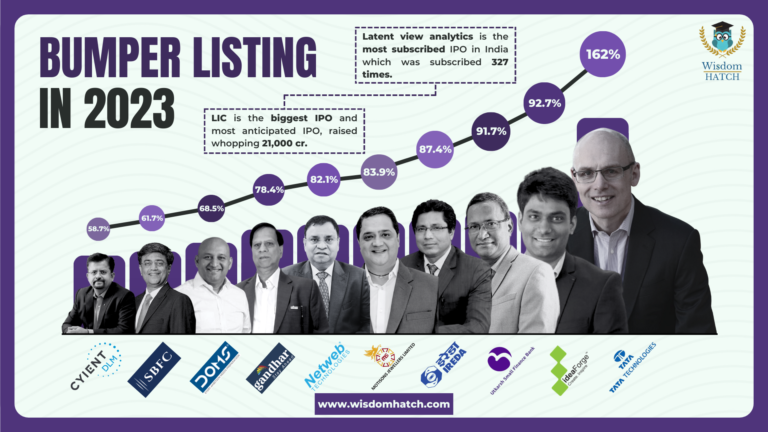

As an example Tata Tech was a hyped IPO under the right market conditions that gave almost a 140% listing gain.

Issue price was INR 500 and the stock listed at INR 1200.

The stock price closed at around INR 1310.

However Jio Financial Services was extremely overhyped and that led to low returns and since then has been sideways.

Since listing at INR 265, it dropped down by 22% the very next day.

2. Understanding the Business Model

Next, gain a clear understanding of the company’s business model.

It’s crucial to know how the company generates revenue and makes money.

This can work even if you believe that the business model is not set as of now, but going forward the company will make money.

For eg: Jio Financial Services was one such company where the business model was not quite clear.

But however people truly believed that the involvement of Mukesh Ambani and his Jio group will ensure that the company will flourish.

However as a counter example: Nykaa (FSN E-Commerce Ventures Ltd) had listed at around 78% listing gains.

However since its listing it has gone down by 58%.

This was because the company’s path to strong profitability was not clear given their low profit Margins.

The DRHP of the company before its IPO will show the company financial and business data.

Take a good look at these numbers.

If the business model is unclear or you don’t have confidence in its future prospects, it’s best to avoid investing in that IPO.

3. Identifying the Competitive Advantage

Identify the competitive advantage or “moat” of the company.

A moat refers to the unique advantage that sets a company apart from its competitors.

For eg:

● Zomato

- Strong Brand

- Advertisements and Distribution

● Apple

- Luxury Brand

- Pricing Power

- Ecosystem play

Look for factors that give the company a significant edge in the market, such as strong branding, innovative technologies, or strategic partnerships.

4. Evaluating the Valuation

Assess the valuation of the IPO to determine if it’s reasonable.

Look at the price-to-earnings (P/E) ratio of the company and compare it with industry averages.

A lower P/E ratio relative to the industry may indicate that the IPO is undervalued, while a higher ratio could suggest overvaluation.

It’s also crucial to check who the underwriter of an IPO is.

An underwriter for an IPO is like a financial middleman that helps a company go public. They assess the company’s value, buy its shares, and then sell them to the public, assisting the company in raising funds for its initial public offering.

Ensure that this is legitimate and that they are credible.

5. Examining Red Flags

Be vigilant for any apparent red flags or warning signs.

This could be bad management, wrong intention for IPOs etc.

Look into the company’s offer for sale versus fresh issue, which indicates whether existing stakeholders are selling their shares or new equity is being added.

An offer for sale in an IPO is when existing shareholders, like company founders or early investors, sell their shares to the public for the first time, allowing new investors to buy a stake in the company.

It’s a way for the company’s original owners to monetize their investment and for the public to become shareholders.

An IPO, or Initial Public Offering, faces fresh issues when a company offers new shares to the public for the first time, raising funds for expansion or other business needs.

These issues involve the company’s financial health, market conditions, and investor sentiment.

Now it becomes important to research why the company wants to do an IPO:

- Is it an OFS/Fresh Issues/ Mix

- What will they do with the money?

This can be found through the DRHP report.

Also take a look at the amount that is being bought by big players like HNIs and Large Institutions vs Retail Investors.

Big players should be equally if not more involved in the IPO.

Additionally, investigate if any major stakeholders are exiting the company, as this could indicate underlying issues.

6. Identifying Tailwinds

Consider any tailwinds or external factors that could positively impact the company’s growth.

Look for industry trends, government policies, or market conditions that could create favorable conditions for the IPO.

These tailwinds can lead to PE expansion in the industry which can drive the stock price and contribute to the company’s success.

7. Assessing Management Quality

Lastly, evaluate the quality of the company’s management team.

Research the backgrounds and track records of key executives to gauge their expertise and experience.

A strong management team with a proven track record can significantly increase the chances of success for an IPO.

For eg: V. Vaidyanathan, who is the CEO of IDFC First Bank, showed a strong management quality which led to the eventual growth of IDFC First Bank.

His expertise and prior experience in the Banking Industry led to the growth of his current company.

This data can also be found through the DRHP.

Important Points to Consider:

Ultimately just like your core investment portfolio, your IPO Investing should also have a clear thesis.

Your investment style, your portfolio concentration and your goal should match your IPO Investing style.

Take the above framework and create modifications to it, add more lenses to pick out your ideal IPO investment so that it tailor fits your needs and your entire portfolio.

There is no 100% clarity when making IPO investments.

You have to be ok with making decisions with 60-70% data.

That level of risk is the reason that IPO investments lead to higher possible returns.

Conclusion

Investing in IPOs can be a thrilling and rewarding experience, but it’s crucial to approach it with a well-defined risk mitigation framework. By following the steps outlined in this blog, you can analyze and assess IPOs effectively, enabling you to make informed investment decisions.

Remember, this blog provides a framework for your analysis and should not be considered as specific investment advice.

Always conduct thorough research before making investment decisions.

Happy investing!

● Understanding IPOs:

- IPOs serve as a transition for companies from private to public ownership, raising capital for growth.

- While offering potential for substantial returns, IPO investing carries inherent risks.

● How to Scout New IPOs:

- Utilize resources like chittorgarh.com to track upcoming IPOs.

- Understand the Draft Red Herring Prospectus (DRHP), a comprehensive document filed by companies before going public.

● IPO Analysis Framework:

[1]Market Situation and Hype:

- Evaluate the market conditions and hype level surrounding an IPO.

- Favorable markets are ideal, but excessive hype may be a warning sign.

[2]Understanding the Business Model:

- Comprehend how the company generates revenue.

- Future Prospects to make money

[3]Identifying Competitive Advantage:

- Identify the “moat” or unique advantage that sets a company apart.

- Assess the IPO’s valuation through metrics like the price-to-earnings (P/E) ratio.

- Check the credibility of the IPO’s underwriter.

[5]Examining Red Flags:

- Be vigilant for warning signs like bad management and analyze the offer for sale versus fresh issues.

[6]Identifying Tailwinds:

- Consider external factors that could positively impact the company’s growth.

- Significance of industry trends, government policies, and market conditions.

[7]Assessing Management Quality:

- Evaluate the management team’s backgrounds and track records.

● Important Points to Consider:

- Investors should align their IPO investment style with their overall portfolio strategy.

- Understand the inherent risk in IPO investments and the need to be comfortable with decisions made with incomplete data.

MUST know BEFORE you become an Airbnb host

Medium Article Preksha Chand edit post MUST know BEFORE you become an Airbnb host Medium Article Preksha Chand edit post MUST know BEFORE you become an Airbnb host Medium...

Make more money from your property: Short-term rental [Airbnb]

Medium Article Preksha Chand edit post Make more money from your property: Short-term rental [Airbnb] Medium Article Preksha Chand edit post Make more money from your property: Short-term rental...

GOA Airbnb Laws: What Hosts Need to Know [2024]

Medium Article Preksha Chand edit post Make more money from your property: Short-term rental [Airbnb] Medium Article Preksha Chand edit post Make more money from your property: Short-term rental...